Pixalate recently released the Q3 2018 Seller Trust Indexes, which rank the overall quality of programmatic sellers across desktop and mobile web (GSTI), mobile in-app (MSTI), and cross-device video (VSTI).

Pixalate has been publishing the VSTI for over two years now, so we looked back at the historical data to see what trends we could uncover.

Key takeaways from the VSTI:

-

Competition among programmatic video ad sellers has increased

-

As a result, there is now less risk in “choosing the wrong partner” for programmatic video

-

Video is highly lucrative for fraudsters, with CPMs above $10 (eMarketer).

The gap between high- and low-ranking programmatic video ad sellers is getting smaller

We index all of the scores on our Seller Trust Indexes, including the final score, which means that the companies aren’t given a score based on an arbitrary grading system. Rather, they are given a score based on how they perform relative to the competition.

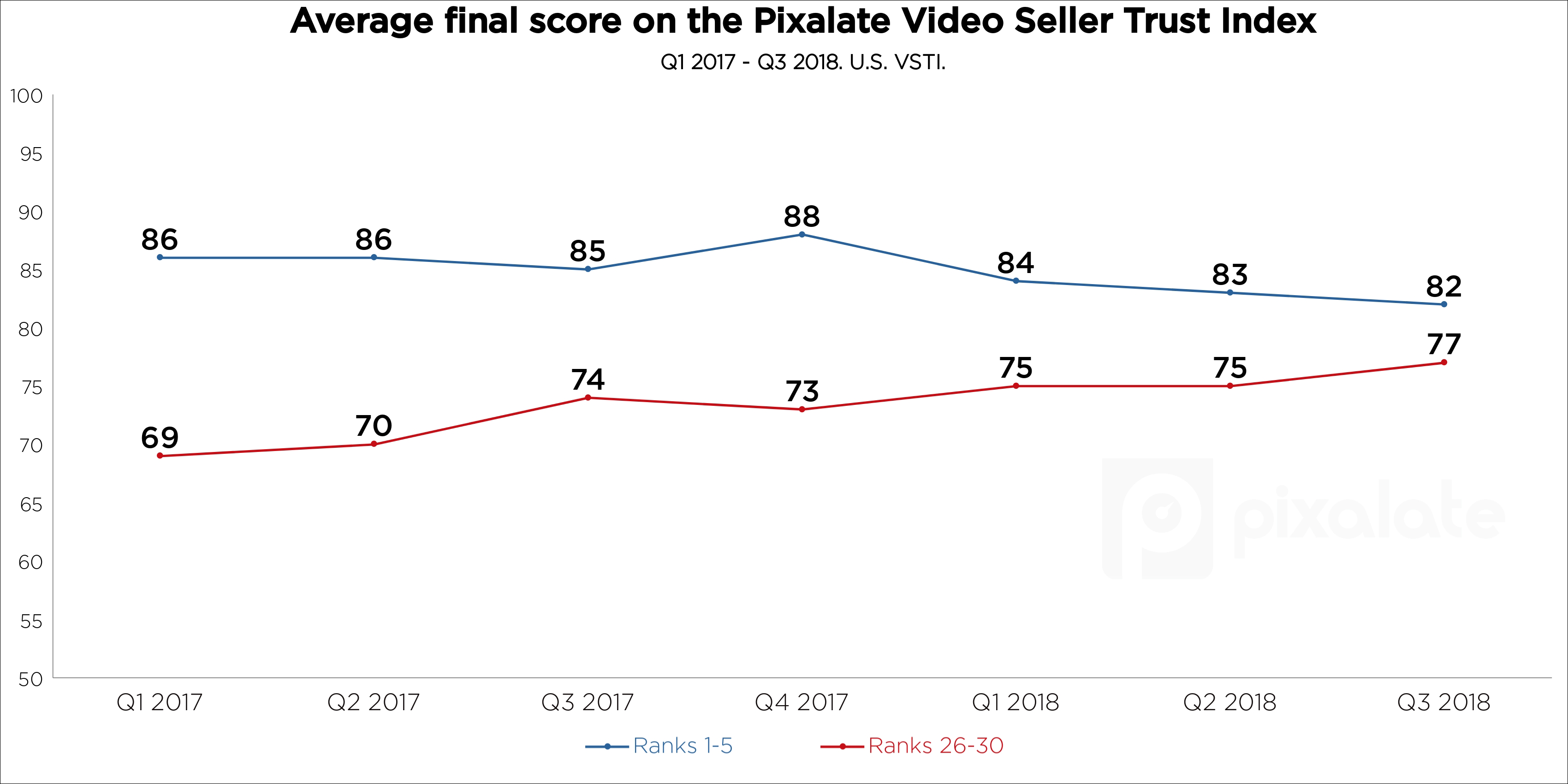

Here’s what it looks like when we take the average final score (per quarter) of those ranked 1-5 and compare it to the average final score of those ranked 26-30:

As the chart clearly shows, the gap is getting smaller.

In Q1 2017 — our first full quarter worth of data for the Video Seller Trust Index — the average score of those ranked 1-5 was 17 points higher than those ranked 26-30.

Nearly every quarter since then, those ranked 26-30 have grown their score at the expense of those ranked higher. In Q3 2018, our latest index, the gap between 26-30 and 1-5 was just five points (82 vs. 77).

The pressure is on to improve quality as fraudsters are attracted to high video CPMs

Remember, all scores in our rankings are indexed, so the fact that companies ranked 1-5 are seeing a steady reduction in “final score” each quarter does not mean that they are getting less and less trustworthy. Instead, it means the competition is heating up.

There used to be big gaps in quality between high- and low-ranking video sellers. Those gaps aren’t as big as they once were, and it could be an indication that video sellers are putting a greater emphasis on video quality due to market forces.

Video commands high CPMs. In the U.S. eMarketer notes that pre-roll CPMs are between $10 and $11. This makes video a highly lucrative channel for fraudsters, but it also puts the onus on video sellers to make sure the inventory is well-lit and of high quality. This pressure is perhaps one driving force behind the trend identified in our index data.

Download our latest Video Seller Trust Index to see where your partners rank.