Pixalate is continuing its analysis of the state of traffic quality in programmatic in Q2 2018 with a look at viewability rates across desktops, smartphones, and tablets across North America. You can download our comprehensive Q2 2018 Programmatic Quality Report here.

Per the Media Rating Council (MRC) standard, an ad is considered “viewable” if at least 50% of its pixels are in-view for at least 1 continuous second (or 2 continuous seconds for video). You can learn more about the standard here.

According to a 2017 World Federation of Advertisers (WFA) study, display viewability rates (globally) were just under 50%. It is important to note, however, that viewability rates can fluctuate on a quarter-to-quarter or even month-to-month basis. Pixalate will continue to track these trends.

Pixalate examined display ad viewability rates, as well as ad share of voice (“SOV”), on desktop, smartphone, and tablet devices across common publisher categories to compile this research. Invalid traffic (“IVT”) was removed prior to measurement.

On desktop devices, the News & Media publisher category had by far the highest display ad SOV, at 41.1%. The next-closest publisher category was Entertainment, with 13% SOV.

Society & Culture (10.1% SOV), Recreation (9.3%), and Computers & Internet (8.1%) rounded out the top five desktop categories in terms of SOV. Overall, these five publisher categories accounted for just over 81% of the programmatic display ad marketplace on desktop devices.

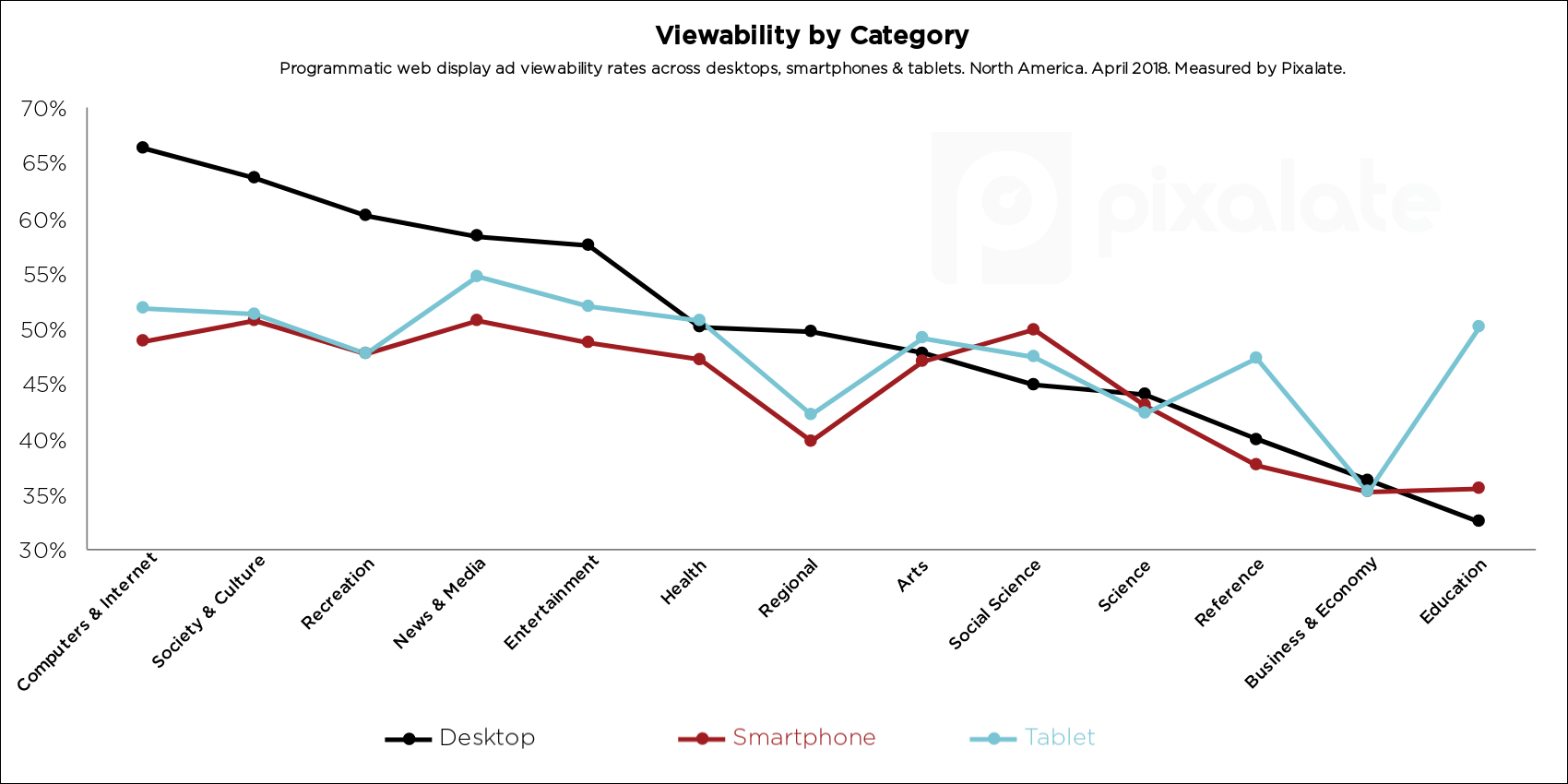

Interestingly, these five categories were also the top five categories in terms of display ad viewability. All five categories had a viewability rate of at least 57.5%. Every other desktop publisher category had a viewability rate of 50.1% or below.

It’s good news that the five biggest categories in terms of ad volume are also the five leading categories in terms of viewability. It means the bulk of desktop display ads have a viewability rate of at least 57% — well above the average cited in the WFA study from 2017.

However, it’s likely not a coincidence that categories that have high viewability rates also have high ad volume. Many marketers today seek inventory with high in-view rates, which will naturally cause them to favor publisher categories that offer above-average viewability.

From the publishers’ perspective, if they have high traffic — and high ad volume — they are more incentivized to place their inventory above the fold or in other places that are likely to generate a strong viewability rate because higher viewability typically equates to bigger CPMs.

The News & Media publisher category had the highest ad SOV for smartphone web display advertising, at 42.7%. This is comparable to the News & Media category SOV for desktop display (41.1%).

Entertainment (20.7%), Society & Culture (10.7%), Reference (7.1%), and Computers & Internet (6.2%) were the top five publisher categories in SOV. Overall, these five categories accounted for over 87% of smartphone web display advertising SOV.

Similar to what we saw for desktop display advertising, these five categories also had high viewability rates. In fact, four of these five categories (all except Reference) ranked in the top five in terms of viewability for smartphone web display advertising.

Society & Culture (50.7%) and News & Media (50.7%) ranked first and second, respectively, in viewability. Computers & Interest (48.8%) was fourth, while Entertainment (48.7%) was fifth.

Only two of these leading categories for smartphone web display advertising registered viewability rates over 50%. This is notably lower than viewability rates for top desktop categories. It’s an important reminder that if you are buying cross-device, viewability rates can greatly differ.

Another interesting takeaway from the smartphone data, in comparison to the desktop data: The ad SOV for the Entertainment category is significantly higher on smartphones (20.7%) compared to desktops (13%).

It’s not a surprise that people want to be entertained when on their smartphones, but this data indicates that smartphone entertainment is not just found within apps — it has extended to the mobile web as well.

The News & Media publisher category had the highest ad SOV for tablet web display advertising, at nearly 50%. The News & Media category easily had the highest ad SOV across desktops, smartphones, and tablets.

Entertainment (17.4%), Society & Culture (12%), Recreation (6%), and Business & Economy (5.5%) were the top five publisher categories in SOV. Overall, these five categories accounted for over 90% of tablet web display advertising SOV.

Not only does the News & Media category account for nearly half of tablet display web advertising, but it also has the highest viewability rate on tablets, at 54.7%.

The same can't be said for the Business & Economy category, which has the lowest viewability rate among all categories (35.2%). So far in this study, we have found that publisher categories that have a high ad SOV tend to also have high viewability rates, but the Business & Economy category on tablets breaks the mold.

Pixalate examined viewability rates across various publisher categories on desktops, smartphones, and tablets to see how the rates compare based on category and device. What we discovered is that if a category is high-ranking in viewability on one device, odds are it will rank similarly on another device.

That’s not to say, however, that the device type doesn’t matter. For example, desktop devices had a very wide range in viewability based on publisher category, with the highest category registering an in-view rate of 66% and the lowest category at just 32% — less than half the amount. Smartphones and tablets did not have nearly as wide of a range.

Here are some ways marketers can put this viewability and category ad SOV data to use:

Importantly, your viewability measurement partner must also be able to detect invalid traffic (“IVT”) across devices, as IVT can have a significant impact on viewability rates. The data shared in this post reflects viewability rates after IVT has been removed. If your viewability vendor is not accredited for IVT detection and filtration, then there’s a chance the viewability rates you receive are artificially inflated.

Download the full Q2 2018 Programmatic Quality Report here.

Pixalate analyzed billions of programmatic advertising impressions throughout April 2018 to compile the research contained herein. Pixalate utilized its proprietary algorithms to measure viewability levels across devices and channels. This data represents the North American programmatic marketplace. Geography is based on the User Pool (IP) and not the region of the domain. Categories of domains that had less than 100,000 impressions were removed from this study. The ad Share of Voice (“SOV”) is based off the remaining categories. Invalid traffic (“IVT”) was removed prior to measurement.

Pixalate is a cross-channel fraud intelligence company that works with brands and platforms to prevent invalid traffic and improve ad inventory quality.

*By entering your email address and clicking Subscribe, you are agreeing to our Terms of Use and Privacy Policy.

These Stories on Mobile

*By entering your email address and clicking Subscribe, you are agreeing to our Terms of Use and Privacy Policy.

Disclaimer: The content of this page reflects Pixalate’s opinions with respect to the factors that Pixalate believes can be useful to the digital media industry. Any proprietary data shared is grounded in Pixalate’s proprietary technology and analytics, which Pixalate is continuously evaluating and updating. Any references to outside sources should not be construed as endorsements. Pixalate’s opinions are just that - opinion, not facts or guarantees.

Per the MRC, “'Fraud' is not intended to represent fraud as defined in various laws, statutes and ordinances or as conventionally used in U.S. Court or other legal proceedings, but rather a custom definition strictly for advertising measurement purposes. Also per the MRC, “‘Invalid Traffic’ is defined generally as traffic that does not meet certain ad serving quality or completeness criteria, or otherwise does not represent legitimate ad traffic that should be included in measurement counts. Among the reasons why ad traffic may be deemed invalid is it is a result of non-human traffic (spiders, bots, etc.), or activity designed to produce fraudulent traffic.”