Want to see the websites? Download the list here.

Note: Pixalate understands that the sanctions are focused on U.S. financial institutions. We are not asserting that any company named in this blog is violating any laws in connection with the purchase of ads on any Sberbank website. It is Pixalate’s intention to make advertisers aware of the adjacency

Sberbank is a state-owned Russian banking and financial services company. It is Russia’s largest financial institution, according to the U.S. Department of Treasury.

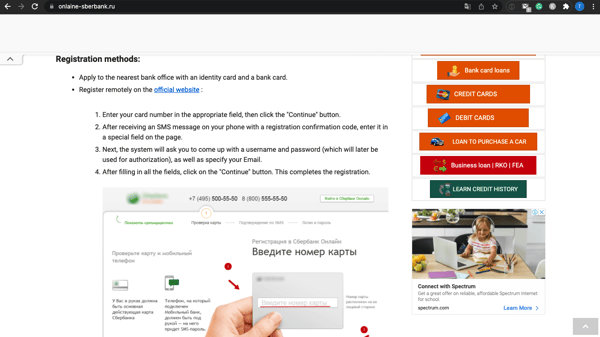

Pixalate has identified at least six Sberbank websites (download list here). At least one of them — onlaine-sberbank.ru — is using Google Ads for monetization as of March 2, 2022.

In a short duration test on March 2, 2022, Pixalate observed the following advertisers appearing to buy ads on the website — several of which are (or are owned by) Fortune 500 companies:

Here are the creatives captured:

Wells Fargo

Spectrum

AT&T (HBO Max promoting Harry Potter)

Square Online (Block, Inc.)

GoDaddy

Hotels.com

AARP and the Ad Council

The Office of Foreign Assets Control (“OFAC”) from the U.S. Department of Treasury maintains lists of sanctioned countries, persons and companies. Individuals and entities in the U.S. (including U.S. branches or subsidiaries of foreign entities) doing business overseas must have robust compliance policies and controls in place to ensure they do not transact improperly with any OFAC-sanctioned countries, entities or individuals. For Russian companies, much of the financial industry is sanctioned currently.

On February 24, 2022, OFAC updated its Russian-related designations and included Sberbank on its correspondent account or a payable-through account (CAPTA) list of sanctioned companies under Executive Order 14024 Directive 2, which covers “prohibitions related to correspondent or payable-through accounts and processing of transactions involving certain foreign financial institutions.” The actions taken against Sberbank require closure of Sberbank correspondent or payable-through accounts within 30 days and prohibit future transactions with Sberbank and certain of its foreign financial institution subsidiaries (unless an express sanctions exemption applies or the transaction is authorized in advance by OFAC via a license).

The U.S. Department of Treasury stated that it has taken “significant and unprecedented action to respond to Russia’s further invasion of Ukraine by imposing severe economic costs,” including sanctions against Sberbank and certain of its subsidiaries.

The U.S. Department of Treasury wrote:

On a daily basis, Russian financial institutions conduct about $46 billion worth of foreign exchange transactions globally, 80 percent of which are in U.S. dollars. The vast majority of those transactions will now be disrupted. By cutting off Russia’s two largest banks — which combined make up more than half of the total banking system in Russia by asset value — from processing payments through the U.S. financial system. The Russian financial institutions subject to today’s action can no longer benefit from the remarkable reach, efficiency, and security of the U.S. financial system.

Download a list of these websites for free here.

*By entering your email address and clicking Subscribe, you are agreeing to our Terms of Use and Privacy Policy.

These Stories on Thought Leadership

*By entering your email address and clicking Subscribe, you are agreeing to our Terms of Use and Privacy Policy.

Disclaimer: The content of this page reflects Pixalate’s opinions with respect to the factors that Pixalate believes can be useful to the digital media industry. Any proprietary data shared is grounded in Pixalate’s proprietary technology and analytics, which Pixalate is continuously evaluating and updating. Any references to outside sources should not be construed as endorsements. Pixalate’s opinions are just that - opinion, not facts or guarantees.

Per the MRC, “'Fraud' is not intended to represent fraud as defined in various laws, statutes and ordinances or as conventionally used in U.S. Court or other legal proceedings, but rather a custom definition strictly for advertising measurement purposes. Also per the MRC, “‘Invalid Traffic’ is defined generally as traffic that does not meet certain ad serving quality or completeness criteria, or otherwise does not represent legitimate ad traffic that should be included in measurement counts. Among the reasons why ad traffic may be deemed invalid is it is a result of non-human traffic (spiders, bots, etc.), or activity designed to produce fraudulent traffic.”